Operate better, faster and for less.

We’ll deliver resilient IT operations that enable better employee experiences, increase productivity and reduce costs and complexity.

Industry Solutions

Deep industry expertise delivered at scale across platforms and digital ecosystems.

Digital Business

Bringing together the best IT services capability across the group to deliver enterprise-grade solutions that help you operate, optimise and transform your business.

Learn moreDigital Infrastructure

Enterprise Applications

IT Outsourcing

Cloud Services

Distribution

Distributor of electronic

components and cyber security

software licensing.

Company Overview

Altron is a proudly South African technology group. A technology industry leader since 1965, we’re partnering with customers across all industries to help them grow, and build a thriving economy.

Company Overview

Annual Financial Results 2024

together.

Enable everyone, anywhere in your business with the information and technology they need to create value.

When you’re supporting a local entrepreneur, shopping at a retailer or buying something online.

When you’re working from the corner coffee shop, the corner office, and anywhere in between.

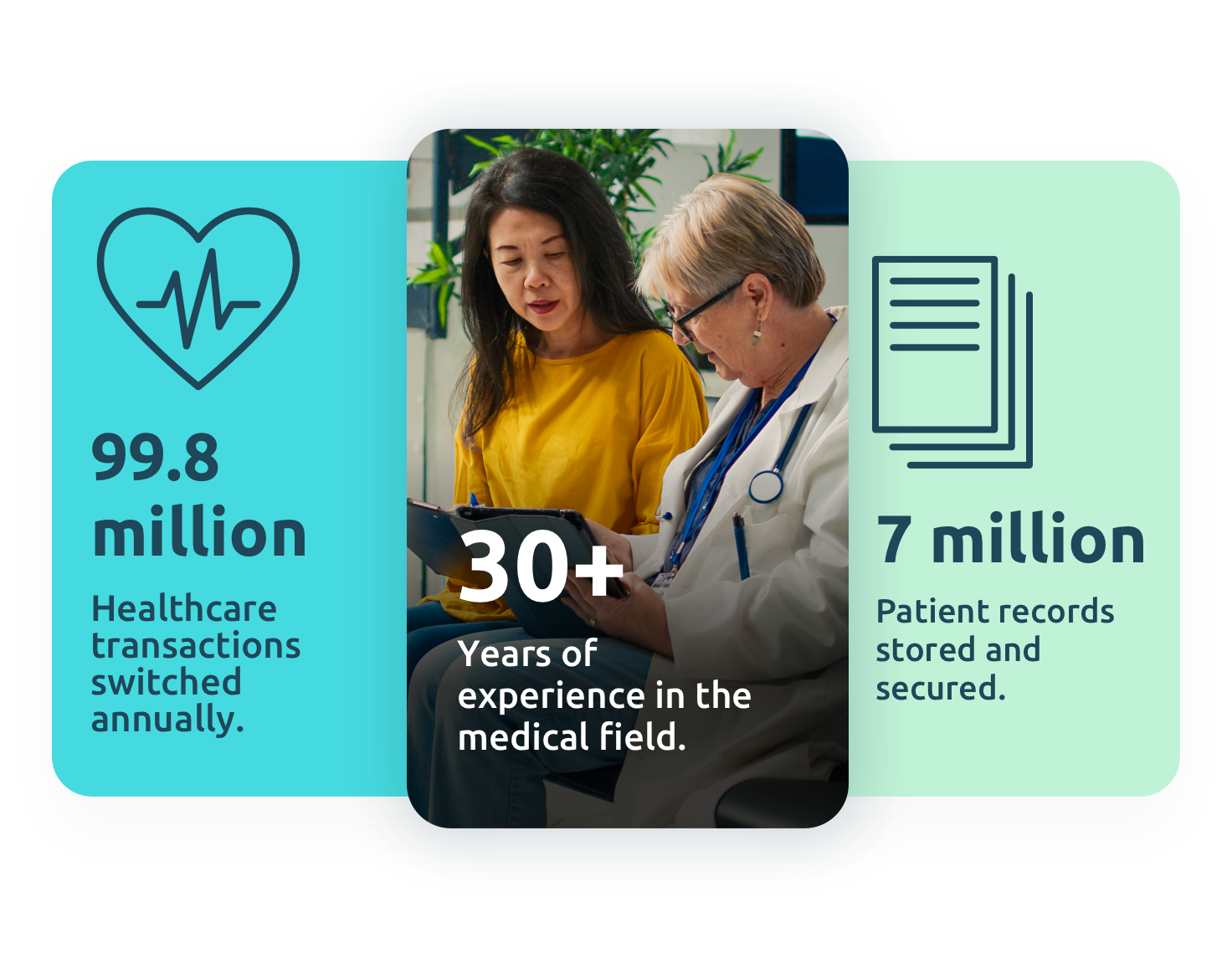

When you’re visiting the doctor, being admitted to the hospital or making a medical aid claim.

When you’re driving home or transporting cargo using a fleet of vehicles.

When you’re using your identity to secure a short-term loan or access to public services.

We’ll deliver resilient IT operations that enable better employee experiences, increase productivity and reduce costs and complexity.

We’ll help you optimise services, processes and assets to grow existing revenue, deliver better customer experiences and accelerate your time to market.

We’ll partner with you to create a future-focused, technology-enabled roadmap that allows you to unlock new revenue streams, reinvent your business model or move into adjacent industries.

We’ll deliver resilient IT operations that enable better employee experiences, increase productivity and reduce costs and complexity.

We’ll help you optimise services, processes and assets to grow existing revenue, deliver better customer experiences and accelerate your time to market.

We’ll partner with you to create a future-focused, technology-enabled roadmap that allows you to unlock new revenue streams, reinvent your business model or move into adjacent industries.

OUR CUSTOMERS

We created the Massmart Tech Booth to support and help them provide employees with more efficient IT support. Offering immediate walk-in support, the Tech Booth handles nearly 1 500 queries each month.

Learn more.png?width=500&height=290&name=Hungry%20Lion%20Image%20(1).png)

We partnered with Hungry Lion to implement and integrate a workforce management solution and a data analysis system to improve profitability for their host of stores both locally and in neighbouring countries.

Learn more.png?width=500&height=290&name=Putco%20image%20(1).png)

Following a large accident that claimed many lives, Putco started using our Netstar Fleet Management System to monitor bus safety and use. Our system has helped Putco drastically reduce accidents and claims recorded against them.

Learn more

A great customer experience is an important business consideration, which is why Vodacom relies on us. From integrating 3.2 billion records into 91 fact tables and 160 dimensions every day to creating personalised offers and everything in between. We help Vodacom deliver exceptional service to their 130 million customers.